More than 58 trillion won has been poured into the initial public offering (IPO) of Big Hit Entertainment, BTS's manage...

- BTS's V To Release Special Christmas Single With Bing Crosby

- BTS's Jin Announces Solo Comeback Date With Teasers For "Happy"

- BIGHIT MUSIC Releases Announcement Regarding BTS's j-hope's Military Discharge

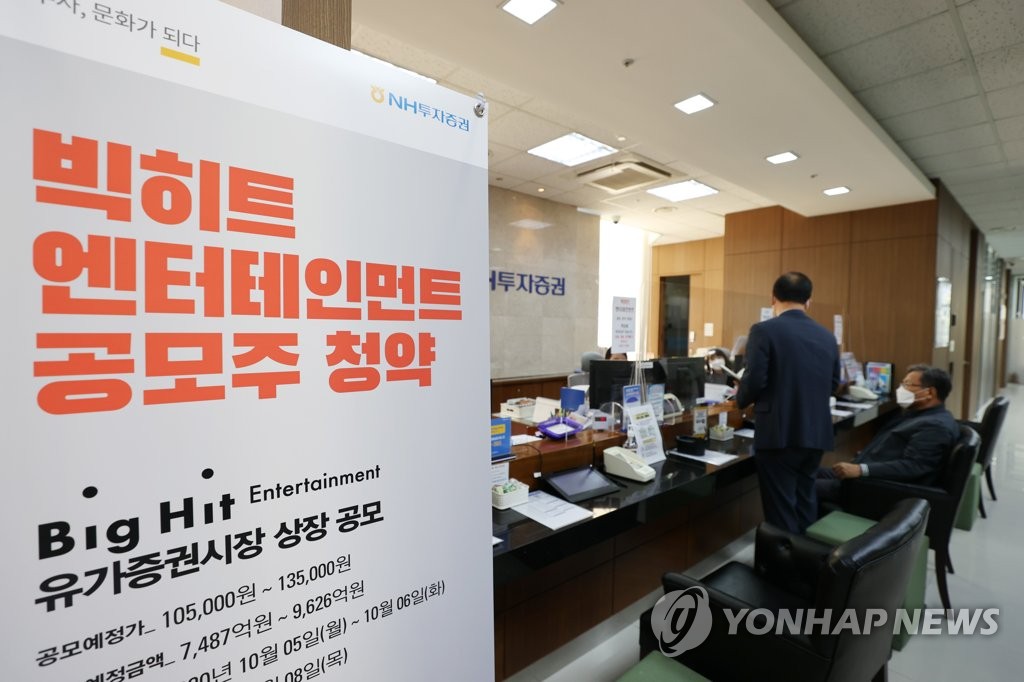

More than 58 trillion won has been poured into the initial public offering (IPO) of Big Hit Entertainment, BTS's management company, ahead of their entering the KOSPI.

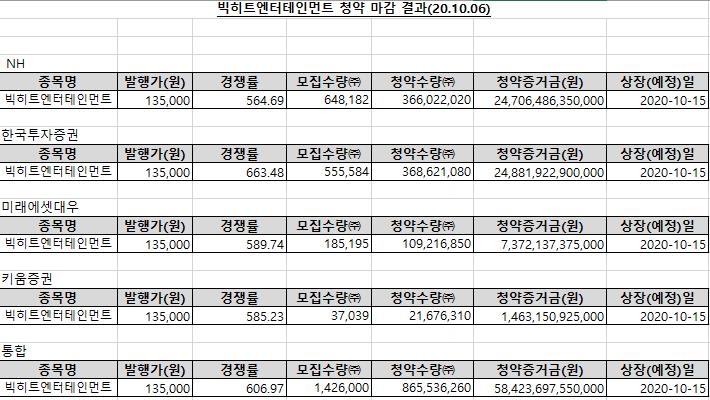

The final amount of deposits calculated by the number of shares that applied for Big Hit subscriptions, compiled by the 4 companies in charge on October 6, was 58.4237 trillion won, and the competition rate was 606.97:1.

The total deposits easily surpassed SKBiopharmaceuticals's 30.89 trillion won, but failed to break the record of Kakao Games (58.5543 trillion won).

By securities firm, the competition rate for subscriptions tallied at NH Investment & Securities, which has the largest number of shares - 648,182 shares, stood at 564.69:1.

Korea Investment & Securities Co., which has 555,584 shares, and Mirae Asset Daewoo, which has 185,195 shares, had a competition rate of 663.48:1, and 589.74:1, respectively.

The competition rate at Kium Securities, with the smallest number of shares allocated - 37,039 shares, is 585.23:1.

The competition rate exceeded SK Biopharm (323.02:1) but fell far behind Kakao Games (1524.85: 1) due to the high public offering price.

Earlier, the day before the first day of the subscription, the deposits gathered at four securities firms totaled 8.6242 trillion won.

The day after the subscription, however, about 50 trillion won poured into the subscription account, almost catching up with Kakao Games' record of deposits.

Big Hit, which finished its two-day subscription, will be listed on the KOSPI on October 15. The IPO price is 135,000 won and the market capitalization is about 4.8 trillion won.